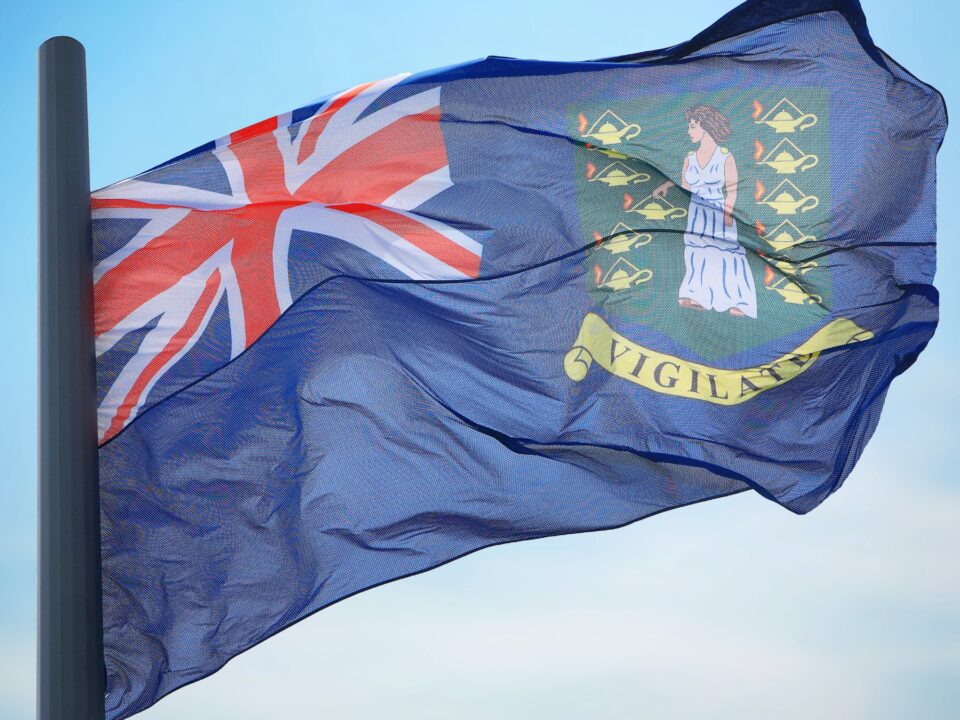

Main Characteristics of a BVI Trust

October 12, 2022

Icaza Trust Corporation wins an award as the Company of the Trust Sector in Panama with the Highest Percentage of Women on its Board of Directors.

April 24, 2023Features and Advantages of a Real Estate Development Trust

By: Estefanía Alemán – General Manager

The purpose of a Real Estate Development Trust is the management of resources and assets pertaining to a real estate development project. The Real Estate Development Trust may have different modalities, and may or may not also operate as a warranty trust.

The modalities of the Real Estate Development Trust can be categorized as follows:

- Management, Warranty, and Source of Payment: the purpose of the trust is to hold as part of its patrimony the property on which the real estate project is developed, manage the financing resources, receive payments for the pre-sales and sales of the project, manage the entire flow of the project and pay its direct and indirect costs, secure the financing with all the assets that make up the trust patrimony, release and transfer the real estate units once they are ready, repay the financing, and distribute the earnings to the developer or partners of the project as appropriate.

- Pre-sales Management: the purpose of the trust is limited to collecting the funds from pre-sales as long as the necessary conditions are met to carry out the real estate project.

- Financing Management: the purpose of the trust is limited to managing the funds from the financing and transferring them to the developer, according to the project’s budget and the inspector’s reports on the progress of the works.

Advantages

The advantages of the Real Estate Development Trust consist of carrying out a real estate development project in an efficient and transparent manner to avoid wasting or diverting resources and, in this way, to be able to guarantee the success of the project to buyers, investors and creditors. In Panama, developing or managing a real estate project under a trust has no tax advantages.

Many developers do not see advantages in using trusts to carry out real estate projects. They usually think that the trust fees are unnecessary and that these vehicles place controls that do not allow the developer to manage the resources and assets of the project at its discretion.

In my experience as a trust manager, most real estate development trusts have come to us when the projects are already experiencing financial or legal problems. In all these cases, if the trust had existed from outset of the project, such financial or legal problems would have been avoided.

Unfortunately, there are developers who use resources from a real estate project to fill gaps or pay off debts from other real estate projects they are developing. This situation causes delays in the works and a final product different from the one originally promised to the buyers. There are countries such as Colombia in which all real estate projects are carried out through trusts in order to guarantee buyers a successful project and a final product under the terms offered.

Why use Development Trust?

Developers should not view the fees or the features of a real estate development trust as a detriment, since such fees range between one and two thousand dollars per month, depending on the size of the project and the scope of the trust. If the project is carried out in an orderly and transparent manner through a trust, at the end of the project, the trust fees invested are much lower than the large sums that projects face when they are not managed under proper practices. Moreover, the confidence of creditors and potential buyers in a project increases when the project is managed through a trust.

Recently, my husband told me about a real estate project that at first glance looked attractive. However, I told him that because of the developer’s reputation for managing their projects, I would not dare to invest in a project managed by them unless the project was managed through a trust. In short, managing real estate development projects through a trust guarantees to all parties involved (clients, creditors, and suppliers) that they shall receive the agreed product within the terms committed under their corresponding purchase, sale, credit, or service agreements, as applicable.