Case Studies: Trusts vs. Foundations

May 24, 2023

Alternatives for the Succession of our Estate

June 4, 2024By: Luis Martínez

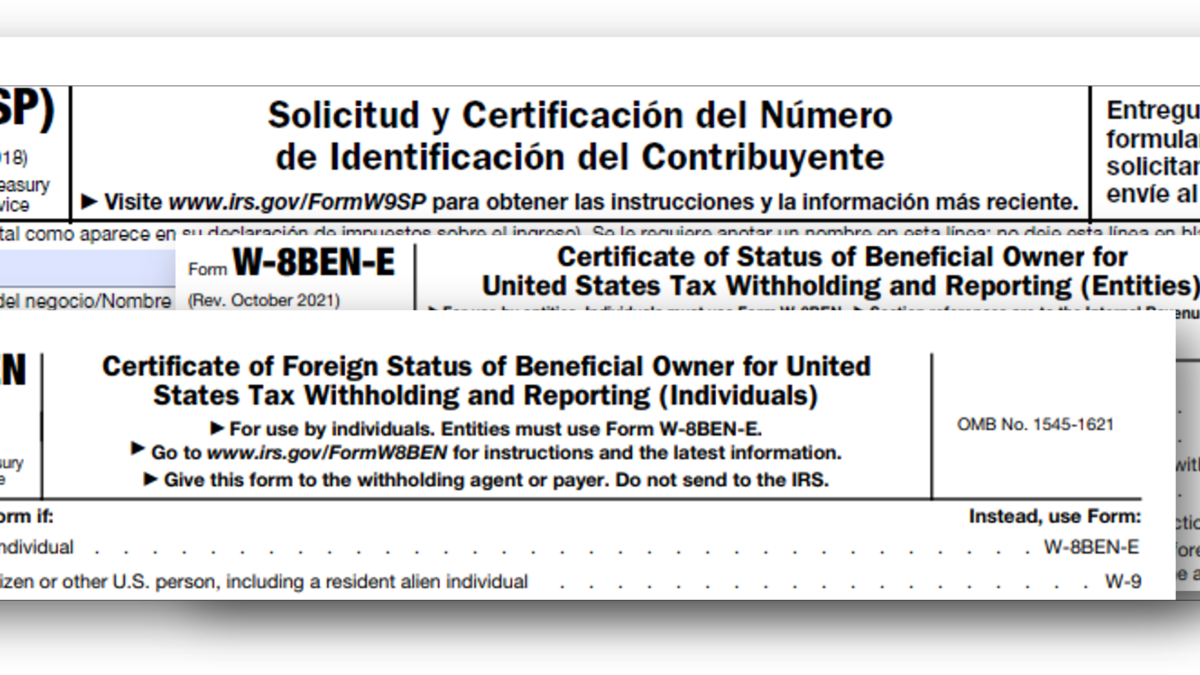

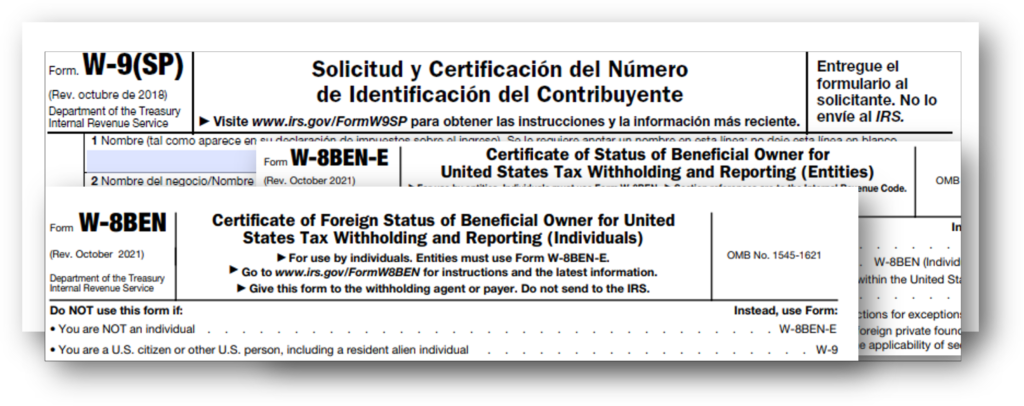

Since the implementation of the U.S. Foreign Account Tax Compliance Act (FATCA), which is intended to detect and discourage tax evasion by U.S. taxpayers with accounts outside the United States, banking and/or financial institutions generally require all their account holders, whether U.S. or non-U.S. persons, to complete a W-series form (W-8 or W-9) in order to identify whether or not they are U.S. Persons.

Under the mechanism implemented by FATCA, the financial institution where the account is held (depending on the IGA [Inter-Governmental Agreement] entered into in each jurisdiction) is the one that must collect data from the taxpayer and then pass it to the competent authority.

What is the W-8 form used for?

What is the W-8 form used for? W-8 forms certify the status of the person who subscribes them. These forms apply to persons who are not considered “U.S. Persons” and therefore are not taxpayers for U.S. tax purposes. The purpose of the W-8 forms is to document the tax status of the non-U.S. person, and to prevent the non-U.S. person from being subject to a withholding.

Depending on the case, the W-8 form also allows the person to claim a tax exemption or reduced tax rate if the person lives in a country that shares an existing tax treaty with the US.

Types of W-8 Forms

The IRS has several W-8 forms, which certify a person’s foreign status from a U.S. tax perspective (Foreign Status).

Below, we explain the different types of W-8 Forms, and when each applies:

- W-8BEN Form: This form is used for a Natural Person.

- W-8BEN-E Form: This form is used for Foreign or Legal Entities to document their tax status from a U.S. perspective.

- W-8IMY Form: This form is used in case of Foreign Intermediaries. That is, it applies to entities that transfer their income to other persons, for example, to their partners, limited liability companies (“LLCs”), or branches of U.S. entities. This form is used to declare and certify if a person or entity received payments subject to U.S. withholding from an individual or entity outside the U.S. This form does not apply to beneficial owners as the previous forms, only to intermediaries.

- W-8EXP Form: This form is used for Foreign Governments or other foreign organizations such as central banks.

- W-8ECI Form: This form is used when there is a claim for exemption from withholding for Foreign Persons on income effectively connected with trade or business within the territory of the United States, or for income taxable by the United States, and applies to all persons who earn income from such sources as Effectively Connected Income or (ECI).

- W-8CE Form: This form is used in the case that a notice of being an expatriate with a special tax status must be given, or to notify a special tax status as a result of a tax treaty.

Validity period of W-8 forms

W-8 forms are valid for 3 calendar years as of the date they are signed, so it is usual for banking institutions to ask their clients to renew them when they expire. Sometimes banking entities have a policy of renewing them before the three (3) year period.

W-8 vs. W-9 Forms

While W-8 forms apply to persons and entities that want to certify their status as non-U.S. persons, W-9 forms apply to businesses, contractors and similar entities that are U.S. taxpayers or U.S. Persons under U.S. law.

These forms do not have an expiration period like the W-8 forms.

In order to be able to review each individual case and choose the correct W-series form for each structure or case, it is important to work with professional advisors who are knowledgeable about FATCA legislation.

A professional can help you determine your tax needs and responsibilities, depending on your country and structure.