Icaza Trust Corporation wins an award as the Company of the Trust Sector in Panama with the Highest Percentage of Women on its Board of Directors.

April 24, 2023

Understanding FATCA Forms

September 26, 2023By: Estefanía Alemán

The first question many of our clients ask is whether we recommend setting up a Trust or a Private Interest Foundation. Additionally, they ask the difference between one structure and the other. I always start by answering that both, the Private Interest Foundation and the Trust, are estate planning vehicles. Through both structures the same purpose is achieved. However, they have different legal characteristics. Furthermore, it depends on the particular situation of each family if a Trust or a Private Interest Foundation is the most adequate estate planning structure for them.

Legal Features of a Private Interest Foundation:

A Private Interest Foundation is defined as a legal person which main purpose is to protect family wealth and serve as an estate planning vehicle. This legal person is administered by a Foundation Council, which has a role similar to the one of the Board of Directors of a corporation. In a Foundation the foundational assets are transferred in the name of the Foundation. The Private Interest Foundation cannot carry out commercial activities. However, it may carry out mercantile activities in a non-habitual manner. These mercantile activities include entering into loan, mortgage, pledge, and purchase and sale agreements, among others.

The Private Interest Foundation is governed according to the terms established in the Foundation Charter and its Regulations. According to the terms and conditions established in the Foundation’s Regulations, the Foundation Council may have discretionary or non-discretionary powers. Likewise, the Beneficiaries of the Foundation may be determined or discretionary. The Foundation may also have a protector or administrative committee that gives recommendations or instructions to the Foundation Council. For a Foundation to function properly and meet its purpose, it is crucial that the Regulations be specific and detailed with respect to the rules of administration and distribution of the foundational assets.

Legal Features of a Trust:

Under Panamanian law a Trust is defined as a “legal act through which a person, called the Settlor, transfers assets or rights to a person called the Trustee, who is obliged to manage or dispose of these assets or rights to accomplish a purpose determined by the Settlor. The purpose may be in favor of a Beneficiary, who may be the Settlor himself, or in favor of the achievement of a purpose determined by the Settlor”.

Under common law, a Trust is defined as a legally binding agreement whereby one person (known as the settlor) transfers assets to another person (known as the trustee), who is vested with legal title to the trust assets, not for his own benefit, but for the benefit of other persons (known as beneficiaries, which may include the settlor), or for a specific purpose.

In a Trust, the assets are administered by the natural or legal person appointed as Trustee. The Trustee administers the trust assets based on the terms and conditions of the Trust Agreement. Likewise, according to the terms established in the Trust, the powers of the Trustee may be discretionary or non-discretionary. The Beneficiaries of the Trust may be discretionary or determined. A Trust may also appoint protectors or committees to give recommendations or instructions to the Trustee regarding the administration of the trust assets and their distribution in favor of the beneficiaries.

Case Study of a Private Interest Foundation:

Context: A patriarch establishes a Private Interest Foundation as Founder, whose beneficiaries are his 4 daughters. The Foundation Regulations establish that the members of the Foundation Council are the 4 daughters of the Founder. The Regulations establish that in case of vacancy of one of the members of the Foundation Council, the remaining members must designate the person who shall fill the vacancy. The members of the Foundation Council have the power to amend the Regulations. The Beneficiaries of the Foundation are the 4 daughters of the Founder and in the event of death or incapacity of one of the daughters, her interest in the Foundation passes to her descendants.

Case: At the time of the Founder’s death, one of the daughters was terminally ill. A few months after the Founder’s death, the sick daughter also passed away. In the months that elapsed between the two deaths, no change was made to the Regulations to establish rules for the substitution of the sick sister in the Foundation Council. When the sick sister died, the surviving sisters appointed the eldest son of one of the sisters as a member of the Foundation Council, instead of appointing a son of the deceased sister. The new Foundation Council amended the Regulations and took decisions that disfavored the deceased sister’s lineage.

Lessons: In the Regulations of a Foundation it is very important to establish clear ground rules on i) the appointment of the members of the Foundation Council, Protector, and committees, if applicable, and their replacement; ii) the powers of the members of the Foundation Council, Protector, and committees if applicable; iii) the rules on amendment of the Regulations and the matters that may be amended by the Foundation Council; iv) and the rights of the Beneficiaries. When the members of the Foundation Council are the children of the Founder and the ground rules are not clear and specific, upon the death or incapacity of the Founder, the children may enter in conflict. Also, if any of the children of the deceased Founder die, the remaining members of the Foundation Council may take decisions that disfavor the deceased child’s lineage.

Would it have been possible to avoid this situation through a trust? Because the Trust is administered by a trustee who is an independent third-party professional, through this structure it is possible to avoid conflict among the beneficiaries with respect to issues related to the administration and distribution of the Trust. For example, if a patriarch/Settlor establishes a trust for the benefit of his 4 daughters and the trust provides that in the event of the death or incapacity of the Settlor the trust assets shall be distributed in favor of the four daughters in equal shares, and that in the event of the death of one of the daughters her portion shall be distributed in equal shares among her heirs, there is no possibility of conflict among the daughters or of changing the terms and conditions with respect to the distribution of the assets.

Case Study of a Trust:

Context: A patriarch/Settlor established a trust in which he stipulated that the first beneficiary was himself, the second beneficiary his disabled daughter, the third beneficiary his disabled granddaughter, the fourth beneficiaries his disabled granddaughter’s offspring if she had children, and the last beneficiaries four relatives once all of the above beneficiaries died. The Protector of the Trust was the Settlor himself and in the event of his death, his brother would succeed him as protector. The Trust provided that the Protector had the power to give instructions to the Trustee regarding the Trust. Additionally, the Trust established in a clause on the destination and distribution of the trust assets that in the event of the death of the first and second beneficiary, the third beneficiary would receive up to US$300,000.00 for living expenses.

Case: The Settlor and his disabled daughter died. The Protector and the Trustee made a comprehensive amendment to the Trust, which established that the Beneficiaries were the four family members. In an audit of the Trust a finding was made that the Protector did not have the power to amend the Trust, and that the comprehensive amendment had left out of the Trust the third beneficiary, who was still alive. The Trustee made the decision to only distribute the Trust upon the ruling of a judge determining the comprehensive amendment was valid. The Trust has not been distributed.

Lessons: In a Trust it is necessary that the terms regarding the powers of the Trustee, the power of amendment, and the rights of the beneficiaries be clear. In the case in question there are significant ambiguities. First, the Trust Deed provides that the Third Beneficiary is entitled to a sum of up to US$300,000.00 for living expenses, but does not establish what other rights she has over the remainder of the trust assets. Second, the Trust is not clear in establishing what is implied by the Protector’s power to give instructions to the trustee about the trust. Some argue that this power only allows the Protector to give administrative instructions on the distribution of the trust assets. Others argue that this power extends to allowing the Protector to make comprehensive amendments to the Trust. Ambiguities and loopholes in the trust agreement cause conflicts between the parties involved in the trust.

Would it have been possible to avoid this situation through a foundation? If the Foundation Regulations had the same type of ambiguities and loopholes, the same type of conflicts would have arisen.

What is more convenient a Private Interest Foundation or a Trust?

As I mentioned before, it depends on the particular situation of each family whether the Trust or the Foundation is the most convenient estate planning structure for them. In a family where there is no conflict and the members of the Foundation Council are able to respect and abide by clear Regulation with no loopholes, the Foundation is an advisable vehicle to carry out a peaceful and extra-judicial succession. The benefits in this case are to be able to carry out the succession while retaining full control of the process without having to deal with the processes of an independent trustee.

In cases in which the family has multiple branches (children from several marriages or different family branches involved), there have been previous conflicts between the children, there are disabled children or children with addictions, there are children with different professional levels (some work and others do not), there are ex-spouses, there are different stages for the distribution in favor of the Beneficiaries, among other complex situations, a trust is advisable. In these cases, through a trust with clear rules and administered by a reputable professional and independent trustee, it is possible to carry out a succession according to the wishes of the patriarch/settlor, while minimizing conflict between the parties involved.

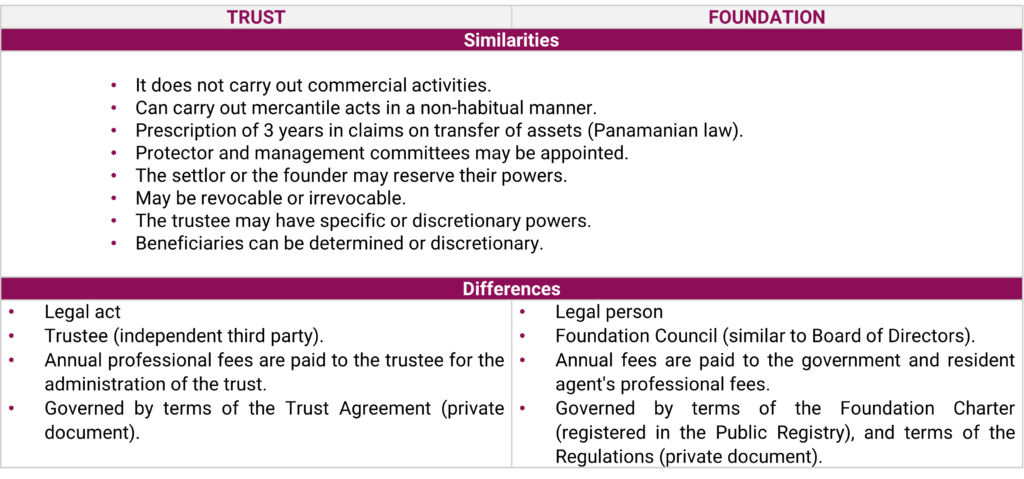

Comparative Table Foundation vs. Trust